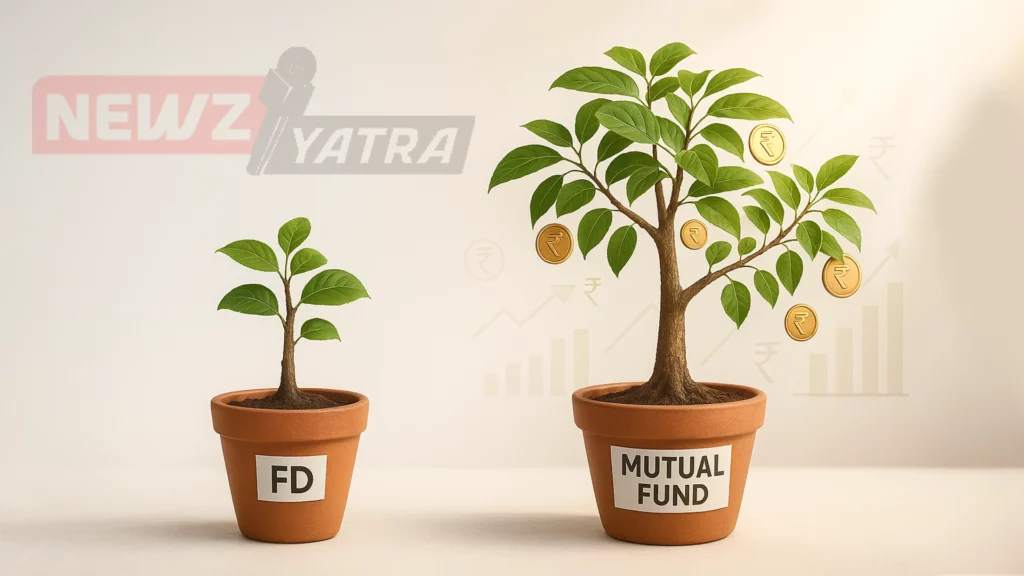

Mutual Funds vs Fixed Deposits: Will Your Money Grow or Disappear

You work hard for your money — now the question is, how should your money work for you? When it comes to growing your wealth, most people find themselves caught between two trusted options: Mutual Funds and Fixed Deposits (FDs). (Mutual fund or fixed deposit which is better)

One promises safety, the other offers growth. One gives peace of mind, the other holds the potential for better returns. But which one truly aligns with your financial goals?

In this blog, we break it down in the simplest way possible — comparing safety, returns, and tax advantages — to help you make a confident and informed choice. Whether you’re a conservative saver or a budding investor, this guide is for you.

Let’s dive in and find out where your money belongs.

Fixed Deposits vs Mutual Funds: Choosing the Right Investment for Your Goals (Mutual fund or fixed deposit which is better)

What Is a Fixed Deposit (FD)? (Mutual fund or fixed deposit which is better)

A Fixed Deposit (FD) is one of the most traditional and trusted ways to save money in India. In this option, you invest a lump sum amount with a bank or financial institution for a fixed tenure — usually ranging from 7 days to 10 years — and in return, you earn a guaranteed interest rate.

Your interest rate is locked at the time of investment, so market fluctuations won’t affect your returns. This makes FDs a low-risk, predictable investment, ideal for conservative investors or those with short-term financial goals.

However, there’s a catch — while premature withdrawals are possible, they usually attract a penalty and reduced interest. So, FDs are best suited for money you don’t need immediate access to.

=> Best for: Investors seeking capital protection, assured returns, and no market-related risks.

What Is a Mutual Fund? (Mutual fund or fixed deposit which is better)

A Mutual Fund is a professionally managed investment vehicle where your money is pooled with that of other investors and invested across a mix of stocks, bonds, gold, or other assets — depending on the type of fund you choose. In simple terms, it allows you to invest indirectly in the market without having to pick individual stocks or time the market yourself. (Mutual fund or fixed deposit which is better)

The returns from mutual funds are market-linked, which means they can fluctuate based on market performance. But over the long term, they have the potential to generate higher returns than traditional savings options like FDs.

There are various types of mutual funds — from low-risk debt funds to high-growth equity funds, giving you the flexibility to choose based on your risk appetite and financial goals. The best part? You can start investing with as little as ₹500 a month through a SIP (Systematic Investment Plan).

=> Best for: Investors who are looking for potentially higher returns and are comfortable with moderate to high risk over the short or long term.

Safety: Where Does Your Money Sleep Peacefully? (Mutual fund or fixed deposit which is better)

Fixed Deposits (FDs):

FDs are known for one thing above all — safety. Backed by banks and regulated by the Reserve Bank of India (RBI), they offer guaranteed returns, making them a go-to choice for conservative investors. Plus, your deposit is insured up to ₹5 lakh per bank under the DICGC (Deposit Insurance and Credit Guarantee Corporation) — adding another layer of security.

=>Risk-free and stable

=> Ideal for those who don’t want surprises

=> No market dependency

Mutual Funds:

Mutual funds, on the other hand, are market-driven instruments. This means their value can go up or down depending on how the market performs. While they’re regulated by SEBI (Securities and Exchange Board of India), they do not offer capital protection or insurance. Among them, debt mutual funds are relatively lower in risk compared to equity mutual funds, but they still carry some degree of market exposure.

=> Returns not guaranteed

=> Involves market risk — especially equity funds

=> More suitable for risk-tolerant investors

=> Verdict:

If capital protection and peace of mind are your top concerns, Fixed Deposits clearly take the lead in the safety department. (Mutual fund or fixed deposit which is better)

Returns: Where Does Your Money Grow Faster? (Mutual fund or fixed deposit which is better)

Fixed Deposits (FDs):

FDs offer predictable, fixed returns, typically ranging between 6% to 7.5% per annum depending on the bank and tenure. While this stability is comforting, there’s a downside — FDs rarely beat inflation. So, even though your money grows, its real purchasing power may decline over time. (Mutual fund or fixed deposit which is better)

=> Guaranteed returns

=> May not keep pace with inflation

=> Better for short-term or low-risk savings

Mutual Funds:

Mutual funds have the potential to deliver significantly higher returns, especially over the long term. Equity mutual funds have historically offered 10%–15% annual returns, though they come with higher risk. Debt mutual funds, while safer, generally provide moderate returns of 6%–8%, often with better post-tax efficiency than FDs. (Mutual fund or fixed deposit which is better)

=> Higher return potential, especially with equity funds

=> Works better with a long investment horizon

=> Returns vary — no guarantees

=> Verdict:

If your goal is long-term wealth creation, mutual funds (especially equity-based) tend to outperform fixed deposits — though you must be willing to handle some market ups and downs along the way. (Mutual fund or fixed deposit which is better)

What Is Life Insurance? A Simple Guide

Taxation: How Much Do You Really Take Home?

Fixed Deposits (FDs):

FDs may seem simple, but when it comes to taxes, they’re not very tax-friendly. The interest you earn is fully taxable as per your income slab, whether you withdraw it or not. If the interest exceeds ₹40,000 in a financial year (₹50,000 for senior citizens), the bank deducts TDS (Tax Deducted at Source) automatically.

=> Interest added to your taxable income

=> No indexation or tax-saving advantage

=> High earners may lose more to tax

Mutual Funds:

Mutual funds offer better tax efficiency, especially if you stay invested for the long term.

- Equity Mutual Funds:

- Short-Term Capital Gains (STCG): If you sell within 1 year, gains are taxed at 15%.

- Long-Term Capital Gains (LTCG): Gains after 1 year are taxed at 10%, but only if they exceed ₹1 lakh in a financial year.

- Short-Term Capital Gains (STCG): If you sell within 1 year, gains are taxed at 15%.

- Debt Mutual Funds (Post-April 2023):

- Gains, regardless of holding period, are now taxed as per your income slab (no LTCG benefit).

- But you still have the flexibility to plan redemptions and defer tax outgo.

- Gains, regardless of holding period, are now taxed as per your income slab (no LTCG benefit).

=>Equity funds offer tax efficiency for long-term investors

=> Smart withdrawal planning can reduce your tax burden

=> No TDS unless you redeem units=> Verdict:

If you’re in a higher tax bracket and plan to invest for the long term, mutual funds (especially equity) can help you keep more of what you earn compared to fixed deposits. (Mutual fund or fixed deposit which is better)

Liquidity: How Quickly Can You Get to Your Money? (Mutual fund or fixed deposit which is better)

Fixed Deposits (FDs):

FDs are known for stability, but not flexibility. While premature withdrawals are allowed, they often come with a penalty — either a lower interest rate or a breakage charge. Plus, breaking an FD might involve a bit of paperwork or branch visits, depending on your bank.

=> Access comes with restrictions and charges

=> Not ideal for sudden financial needs

=> Limited flexibility

Mutual Funds:

Mutual funds, especially open-ended ones, are generally much more liquid. You can redeem your investment anytime (except in cases like ELSS which has a 3-year lock-in), and the money is typically credited to your bank account within 1–3 working days.

=> No penalties for redemption

=> Faster access to your funds

=> Greater control in emergencies or market shifts

=> Verdict:

When it comes to quick and easy access, mutual funds take the lead. They offer more liquidity and freedom to manage your money on your terms. (Mutual fund or fixed deposit which is better)

Best Health Insurance Plans in India (2025): Compare & Choose Wisely!

What’s the Best Fit for You? (Mutual fund or fixed deposit which is better)

There’s no absolute winner — because the best option depends on you.

If your top priority is safety and predictable returns, Fixed Deposits offer peace of mind with guaranteed interest and zero market risk. They’re ideal for conservative savers, short-term goals, or emergency funds.

But if you’re aiming for long-term growth, beating inflation, and better post-tax returns, Mutual Funds — especially equity funds — are designed to grow your wealth over time. They work best when paired with patience and a bit of risk tolerance. (Mutual fund or fixed deposit which is better)

=> Smart Tip: Why not use both?

Consider FDs for stability and Mutual Funds for growth — together, they can form a solid, balanced financial plan.

At the end of the day, your financial goals, investment horizon, and comfort with risk should drive your decision. Don’t just follow the crowd — follow what suits your journey.

Whether you’re leaning toward the safety of FDs or the growth potential of Mutual Funds, the key is to align your investments with your goals. (Mutual fund or fixed deposit which is better)

=> Still unsure what’s right for you? (Mutual fund or fixed deposit which is better)

Let us help you build a personalized investment strategy that balances risk, returns, and peace of mind.

=> Talk to a financial expert today

=> Start your SIP or open an FD in just a few clicks (Mutual fund or fixed deposit which is better)

Your money deserves more than just sitting idle — make it grow, the smart way.

What Is Insurance? Complete Guide to All Types of Insurance Explained Simply!

FAQs

1. Which is safer: Fixed Deposit or Mutual Fund?

Answer: Fixed Deposits are safer because they offer guaranteed returns and are not affected by market changes. Mutual Funds carry some level of market risk but can offer higher returns over time.

2. Can Mutual Funds give better returns than FDs?

Answer: Yes. Over the long term, mutual funds — especially equity mutual funds — have the potential to give higher returns than fixed deposits, though they also involve higher risk.

3. Are mutual fund returns guaranteed?

Answer: No. Mutual fund returns are market-linked and fluctuate based on market performance. There are no guaranteed returns, unlike fixed deposits.

4. What is the tax on Fixed Deposit interest?

Answer: Interest earned on FDs is fully taxable as per your income tax slab. If it exceeds ₹40,000 in a year (₹50,000 for senior citizens), TDS is deducted by the bank.

5. How are Mutual Funds taxed in India?

Answer:

- Equity funds:

- Short-term (≤1 year): 15% tax on gains

- Long-term (>1 year): 10% tax on gains above ₹1 lakh/year

- Short-term (≤1 year): 15% tax on gains

- Debt funds (after April 2023): Gains taxed as per your income slab, regardless of holding period.

6. Is it better to invest in SIP or FD monthly?

Answer: SIPs in mutual funds can offer higher returns over the long term but involve market risk. Monthly FDs are safer but offer lower returns. SIPs are better for wealth creation; FDs are better for capital safety.

7. Can I lose money in Mutual Funds?

Answer: Yes, since mutual funds are subject to market risks, the value of your investment can go down. However, long-term investments often recover and grow over time.